In the fast-moving consumer goods (FMCG) industry, the role of product strategy in company valuation and M&A efforts cannot be overstated. Product plays a significant role in FMCG company valuation since it drives consumer demand and generates revenue. Investors, acquirers, and financial analysts consider the quality of a company’s products, market share, and growth potential when valuing it.

Mergers and acquisitions (M&A) are complex transactions that require significant due diligence in order to successfully integrate the entities involved, whatever could be the reasons for the companies pursue M&A, e.g. 1. Access to new markets, 2. Cost synergies 3. Product portfolio expansion, 4. Diversification, 5. To increase market share, 6. New distribution channels, 8. Improved supply chain, 9. R&D capabilities & Access to new talent etc. a company’s product strategy, including product development, marketing, and pricing, directly impacts revenue growth, customer retention, and overall profitability.

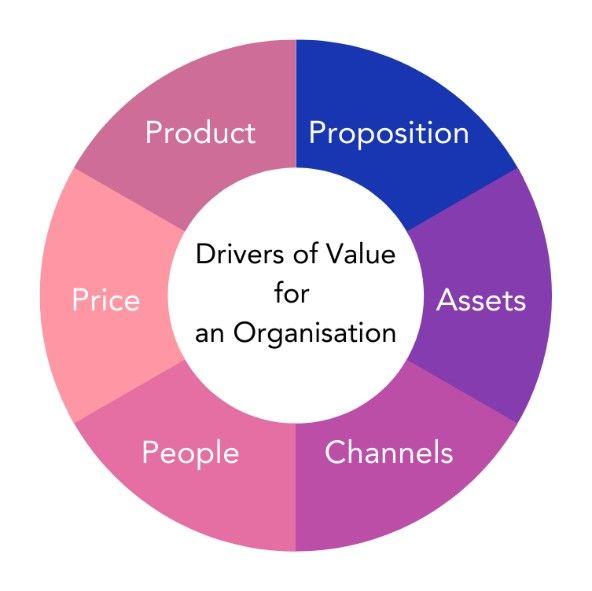

The product itself, the other four elements of the marketing mix (price, packaging, place, proposition, and promotion) are also essential considerations in M&A and company valuation. An effective product strategy is only possible when these elements work together seamlessly.

One of the critical aspects of due diligence for R&D professionals involve evaluating the target company’s intellectual property – this includes assessing the validity and enforceability of patents, trademarks, copyrights, and other IP assets. It is essential to ensure that all IP rights are properly assigned, recorded, and maintained to avoid future legal disputes. Additionally, employee skills and Talent due diligence is also a crucial aspect of M&A transactions. Evaluating employees’ skills and contributions is also important to assess how they fit into the combined entity. In summary, conducting thorough due diligence is vital to achieving a successful merger or acquisition and avoiding any potential pitfalls down the line in the FMCG companies M&A

For example, successful FMCG companies in personal care, home care, and color cosmetics have leveraged product strategy in their M&A efforts. Unilever’s acquisition of Seventh Generation, a leading eco-friendly household cleaning products brand, helped the company expand its portfolio of sustainable home care products and access new distribution channels. Similarly, Estée Lauder’s acquisition of Too Faced Cosmetics, a popular color cosmetics brand, allowed the company to diversify its product portfolio and target a younger consumer demographic.

But it’s not just about M&A. R&D is another crucial aspect of product strategy that can impact company valuation. Investing in new product development can lead to innovation, improved brand value, and increased market share. For example, L’Oréal’s investment in personalized skincare technology has helped the company stay ahead of competitors and appeal to consumers’ desire for tailored products.

Of course, product strategy isn’t without its challenges. Companies must carefully balance the costs and risks of R&D with the potential rewards, and they must also consider consumer trends and demands. Currently, some of the biggest trends in the FMCG industry include sustainability, wellness, and e-commerce.

The multipliers a company can demand depends on the strengths it has. However, the product performance is a critical factor that the buyer should consider in agreeing the right value for the company being acquired. In FMCG, trials can be generated in several ways, but the repeat purchase only happens when the product deliver the performance which it promised. Consumers seldom buy the product that she/he didn’t like even if the advertisement/communication resonate with her/him. The cost of acquisition of consumers and its trendline, are a critical aspect that tells the tale of quality of the product. Cost of acquisition of consumer don’t come down if the quality of the product doesn’t live up to the expectation of the consumers and sustaining such business profitably will always be is challenge.

How do we understand the quality of products like skin care, hair care, color cosmetics, laundry detergents etc.?

We do the following to come to a decision of the holistic product performances:

- Chemical breakdown analysis of the formulation in combination with heuristic rules

- Technical product performance understanding

- Expert panel evaluation of the products comparing the product with the key competitor products.

- Sensory panel studies of the product comparing with the key competitor product.

- Social listening on what users are saying about the product

If the products are superior, then a premium on the pricing can be charged. The price multiple will be lower if the products are inferior to the competitor products.

Understanding product performance is critical for the decision on acquisition and pricing for merger and acquisition.

We use our deep expertise on market product understanding and forensic to provide guidance on strength of the products.

In summary, a strong product strategy can play a vital role in company valuation, M&A, and R&D efforts in the FMCG industry. By focusing on product, price, packaging, place, and promotion, companies can stay competitive and achieve their growth goals. With careful evaluation and strategic planning, FMCG executives can leverage product strategy to create long-term value and success.